t

growth. We're seeing real growth in

ad-funded opportunities. We just

signed our biggest ever global

partnership with a global financial

services brand – we’re creating

television shows for them. But

advertisers are not short of media

opportunities, so we have to keep

working hard to differentiate

ourselves and try to explain why

Bloomberg's channels are worth

spending their money on when

perhaps they haven’t historically

ever considered us. It takes time.

It’s not a quick win.

Do advertisers have a preference

which channel they want to be on?

They’re most hungry for ideas that

help them stand out, like content

development or joint programming

opportunities. Leveraging our

brand relationship with the

audience is what they're most

interested in. When they think

about channels, they're most

interested in digital and television.

And the power of television is still

really clear to me and to us. We've

got to help advertisers understand

that we have a very significant TV

presence, albeit for a narrow, yet

very sought-after, affluent

audience.

Our advertising sales teams are

integrated so they sell audiences,

they don't sell channels. Ironically,

one of our biggest growth channels

year-on-year has been

Businessweek

magazine. A digitally growing

audience and a weekly magazine

under the same brand seems to be

something advertisers are quite

keen to buy into.

Does the regulatory regime give

you sufficient flexibility for content

partnerships and ad-funded

programmes?

Yes, we work under the Ofcom

rules. And we would never trick

our audiences into thinking

something is not funded by a third

party when it is. When associating

a brand with programming we're

making, we make it very clear that

the programming is in association

with the brand but we have full

editorial control. Other formats

which are wholly funded by the

advertiser, overseen by our

editorial team but created by other

commercial editors are clearly

labelled as advertisements.

You're moving into a new building

in 2017 – how do you future-proof it?

The brief has been to build in as

much flexibility as possible into the

new building. So for the new

Bloomberg Media floor, that means

enabling us to move things around,

so we can adapt quickly. We've

created some space around the

studio floor which will be in the

middle and we'll have an area

around it to host live audiences.

We are also taking a good look at

the CMS systems and our ability to

move stories between the channels

very quickly. Plus how best to

create digital-first TV. But some

things are going to remain constant.

You are still going to want to have a

face and a camera – and on

television particularly, it’s got to

look great.

Adam Freeman, thank you.

THE CHANNEL

|

IN CoNVERSATIoN

t

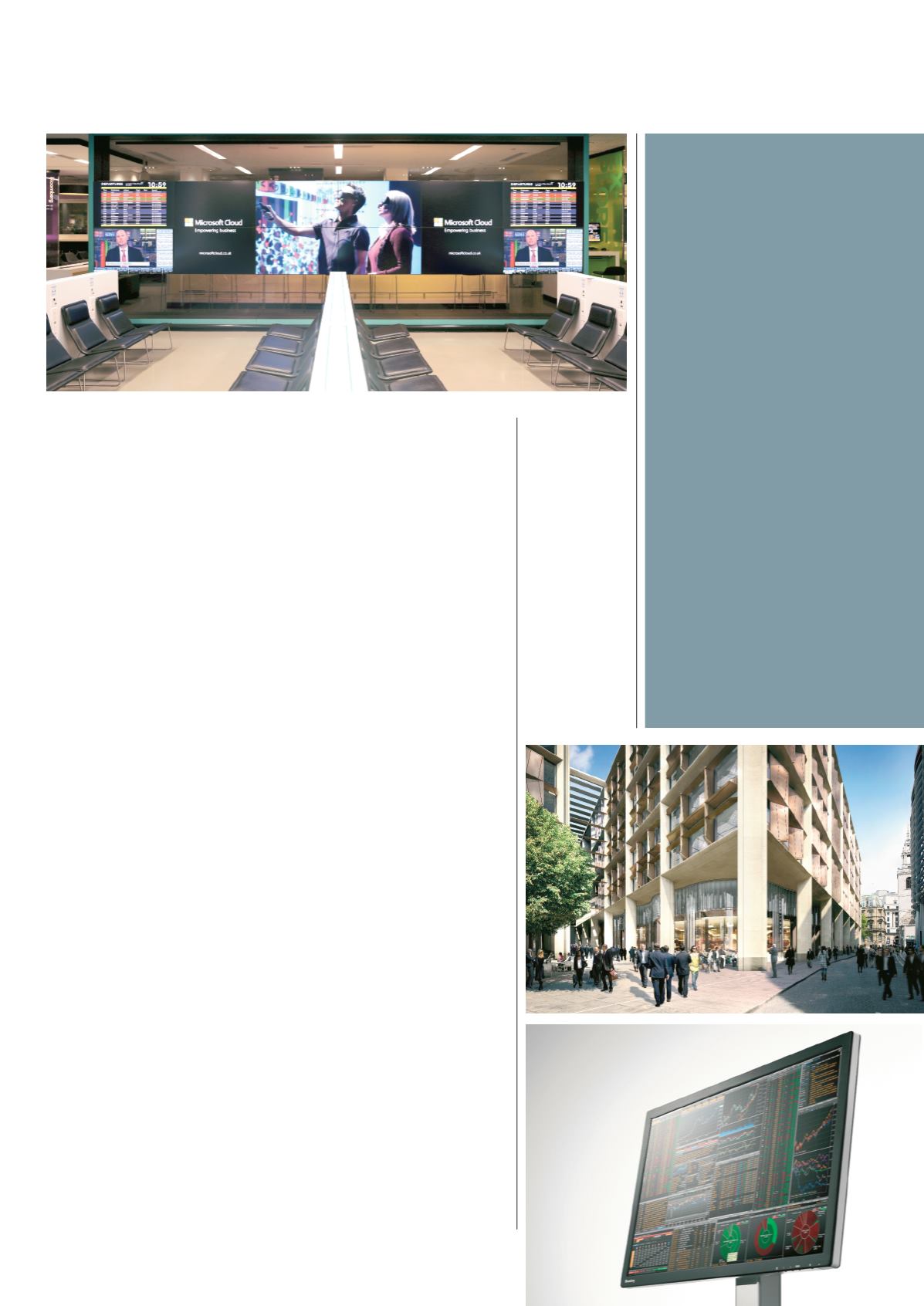

Microsoft, the

first ad partner at

the Bloomberg

Hub, London City

Airport

Artist's

impression of

Bloomberg's new

European HQ, City

of London;

Below: The

Bloomberg

Professional

service,orTerminal

Ipsos Affluent Survey Europe

2015

This year’s Ipsos Affluent Survey

Europe confirms Bloomberg

Media as the number one

business media brand in

Europe. The results, in a survey

of the top 13% of adult European

consumers (based on personal

income), demonstrate the high

influence and value of the

Bloomberg Media audience,

showing them to be 43% more

influential than the average

survey respondents, as well as

collectively in command of Euro

3.9 trillion of corporate spend.

The survey confirms Bloomberg

TV as the business and financial

TV channel of choice for

advertisers wishing to reach

upmarket business professionals

during the business day. The

data also shows the strength of

Bloomberg Media’s digital

products. Bloomberg Media has

the highest reach of high-net-

worth individuals (Euro 950k+

private investments excluding

home/mortgage), C-suite

officers, business decision

makers and financial professionals

in the competitive set.

20

|

ISSUE 2 2015

|

THE CHANNEL