www.aib.org.uk

www.aib.org.uk

44

|

the

channel

During the past decade, private satelliteTV channels have taken

media

markets in the Middle East and NorthAfrica by storm. With them come

innovative programming and unscripted formats, such as talk shows

and roundtable discussions, to Arabs across national borders. Radical

changes to Middle Eastern media consumption habits are underway.

Gone are the days when state-owned television channels, whose

programmes glorified the government’s latest achievements, were the

only viewing options for Middle Eastern consumers.

The proliferation of these pan-Arab broadcasters, such as Al-Jazeera,

MBC, and Future TV, has received much attention, but up until recently,

researchers and media producers have had little quantitative data to

demonstrate these satellite channels’ success. During the summer of

2003, InterMedia Survey Institute conducted six surveys in the Middle

East and NorthAfrica, providing much needed data about regional media

markets, many in the midst of transition from state-run media monopolies

to increasing, if not sometimes chaotic, competition.

The surveys took place in countries as diverse as Kuwait, with a gross

national income (GNI) per capita of $18,270, and Egypt, with a GNI

per capita of $1,530 (2001 World Bank Development Indicators). Yet

despite political and socio-economic differences between these societies,

the surveys suggest discernible trends in the region’s television markets:

the impressive growth of satellite access, the emergence of more than a

dozen private Arab satellite channels, and the contest among private

and state-owned satellite stations to attract regional audiences.

The growth of satellite TV

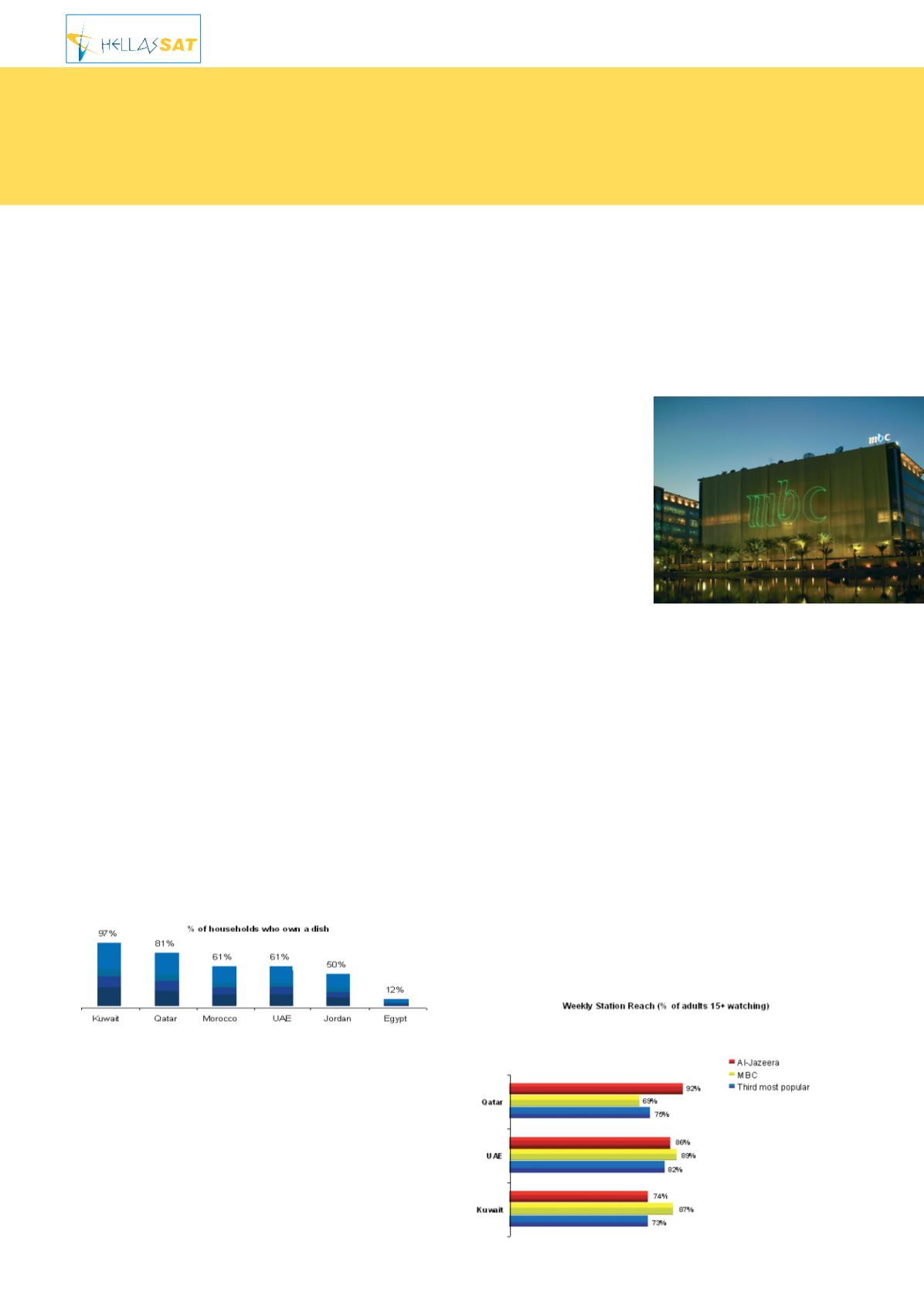

By 2003, satellite TV access was pervasive throughout the Middle East

and NorthAfrica (table 1 below). In some wealthier, oil-exporting Gulf

countries, over 95 percent of households surveyed had a satellite dish.

Ownership elsewhere in the region, from Jordan to Morocco, hovered

between 50 percent and 60 percent. Access was lowest in Egypt (12

percent), arguably due to the relatively high cost of satellite dishes and

the presence of appealing domestic terrestrial stations.

Two factors are driving the propagation of satellite TV in the Middle

East. Technological improvements have substantially reduced the cost

of dishes to roughly $200, making them accessible to more consumers.

Moreover, private satellite networks have emerged, givingArab viewers

sophisticated programming that rivals government-owned channels and

Western outlets.

The first private Arab satellite channel launched in 1991—the Middle

East Broadcasting Corporation (MBC)—was largely financed by Saudi

investors impressed by CNN’s success during the Gulf War. Although

initially headquartered in London, MBC targeted Arab viewers with

newscasts inArabic by reporters with regional expertise, extensive field

coverage, discussion forums, and an aura of professionalism then

uncommon in the Middle East.

MBC’s success in news coverage, and later in entertainment, spurred an

industry of privateArab satellite

channels in the early 1990s,

mostly funded by investors from

Saudi Arabia, the Gulf, and

Lebanon. The most famous

example isAl-Jazeera. Founded

in 1996, the channel originally

garnered

the

Qatari

government’s substantial

backing but was nominally still

a private enterprise. By 2003,

over a dozen private networks

had appeared, such as Dream

TV, LBC, and Orbit, with

content ranging from modified

versions of popular American

shows (for instance,

Who Wants to Be a Millionaire

?) to Al-Jazeera’s

andAl-Arabiya’s news coverage and analysis.

Responding to these channels’ surging popularity, states throughout the

Middle East and North Africa established their own satellite stations.

By 2004, every regional government had a satellite network, such as

the Egyptian Space Channel (ESC). Although many governments

aspired to duplicate the success of private channels, only a few state-

owned stations, such as Abu Dhabi TV, have captured the attention of

audiences beyond their domestic market.

The regional contest for Arab viewers

The growth of private satellite channels in the Middle East has been

dramatic. In some cases, such asAl-Jazeera’s and MBC’s, their viewing

rates now rival or exceed those of domestic stations, both terrestrial and

satellite. In the Gulf countries, surveys showed the overall weekly reach

of these pan-Arab satellite channels surpassing that of domestic TV

stations (see table 2 below).

In Jordan, MBC and Al-Jazeera ranked third and fourth, respectively,

in weekly reach, close behind domestic stations JTV 1 and JTV 3.

Pioneering satellite TV channels

energise Arab media market

It’s a brave new world in Arabic-language broadcasting say

Carole Chapelier

and

Ada Demleitner

, Research Managers for the Middle East and North Africa

at

InterMedia Survey Institute

, Washington DC

Satellite Dish Access

The MBC building at Dubai Media City

the channel

- supported

by