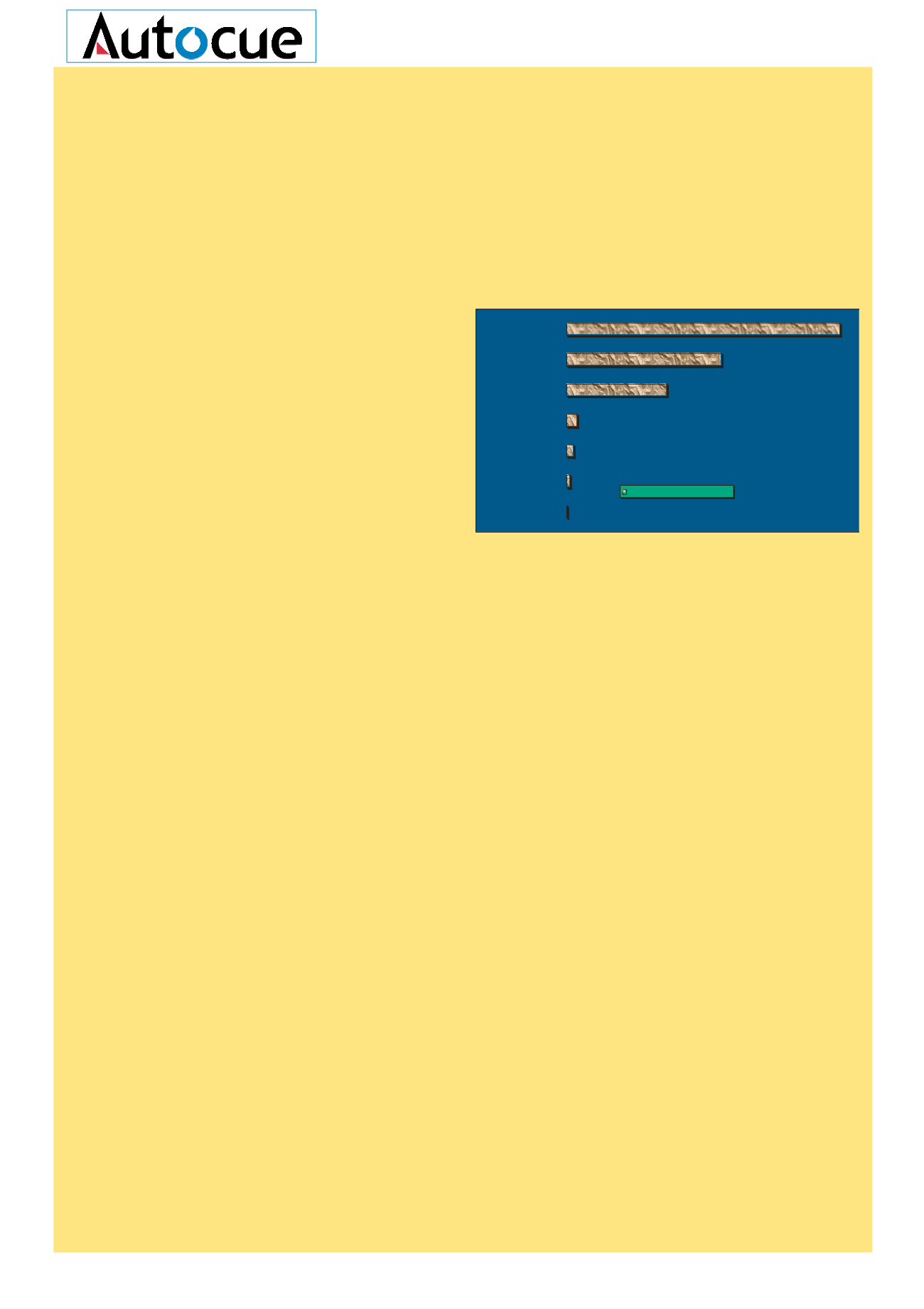

1

4

8

12

110

170

300

Analogue

Digital9MHz

Digital4.5MHz

WithStatMuxing

MPEG4 @400kbps QPSK

MPEG4 @400 Kbps 8PSK

and with16QAM@300kbps

TV channels persatellite transponder

It isn’t that long ago – certainly less than a decade – that

TV signals delivered by satellite required a full transponder

to deliver the signal directly to home. Those heady days of

entirely analogue delivery, wholly government-owned

satellites and 30 metre transmit antennas are rapidly

disappearing into the memories of fewer and fewer industry

engineers and executives. Thank goodness!

At first, the introduction of digitalisation threw the industry

into a bit of a panic. Firstly, satellite operators could now

make much better use of the satellite space segment

frequencies available to them; with the adoption of the

MPEG2 compression standard they could easily

accommodate four 9MHz channels within a 36MHz

transponder. With rapid improvements in the MPEG2

encoding equipment, this increased twofold to provide eight

TV channels in the same amount of space segment. Further,

the introduction of statistical multiplexing improved that

yield to between ten or even twelve television channels

per satellite transponder.

The satellite operators suddenly had much more stock in

their warehouse than had previously been anticipated and

satellite manufacturers were concerned about future sales

in terms of their order book. The search for more televisual

content had begun. So we saw – and still see – the

proliferation of the narrow-interest or niche-market TV

channels developing; shopping, holiday, additional sporting

information, historical and geographical channels, et al..

The price of a TV channel on a satellite transponder reduced

in price sufficiently to allow access to those TV broadcasters

for whom the price barriers of entry had previously been

far too high into the market.

Using the same techniques, the digitisationof the satellite space

segment meant that private data networks could be managed

cost effectively by corporates and enterprise business alike.

TheMPEG2 encoding and compression standard has served

the industry – and the consumer – extraordinarily well. It

has supported our digits, carried our conditional access

information, secured the set-top-box as a household item

and allowed us to interact with our TV sets as never before.

In order to get the industry this far, there has been an

inordinate effort by the satellite engineering community

to appropriately “groom” each transponder on every

satellite, to accommodate the digital channels. This has

been undertaken to minimize wastage of valuable space

segment frequencies available for commercialisation by

the operator. Some have performed this rather better than

others; and there is still some way to go before there is an

absolute analogue cut-off date for satellite delivered

services – even though some TV channels have called time

on their own analogue services.

There is no doubt that the increased space segment capacity

availability versus the increase in channel content has been

a hard-fought balancing act and has certainly taken its toll

in transponder revenue in recent years – especially since

the

dot.combubble burst. This year reported revenues for

fixed satellite service operators reduced 6% according to

Euroconsults’ 10

th

edition of the World Satellite

Communications & Broadcasting market Survey. The

balancing act is certainly responsible for a number of

mergers and acquisitions throughout the industry, such as

SES-Global (GEAmericom and partnership withAsiaSat),

Intelsat (with its recent Loral satellite procurement),

Eutelsat (acquisition of the Stellat satellite, now AB3)

amongst others.

To date, the satellite operators have largely held their own.

They have maintained and increased their customer base

and manage satellite procurement to meet their ongoing

needs. I asked a number of representatives for their insight

into the current – and future – situation.

Sabrina Cubbon, General Manager, Marketing at AsiaSat,

“Over 97% of the television services on AsiaSat are now

digital, we therefore do not expect the ongoing process of

digitalisation would have a significant impact on our

future revenue. Customers who have transformed from

analogue to digital transmission use its existing capacity

to launch more channels. New players are able to launch

new services at a lower entry cost as digitalisation allows

them to lease less capacity for regional coverage on a hot

bird. Though the global transponder market is yet to

recover, we are optimistic in the long term, in particular

the C-bandAsian market where supply is still limited.With

its ubiquitous reach and wide coverage, satellite-

based solutions are the most ideal for the diverse Asia

Pacific region.”

Exponential Potential

Satellite Space Segment Set for

Super Digitalisation

www.aib.org.uk42

|

the

channel

Lots more capacity in the digital environment

The Channel

- supported by