It’s one of the “big ticket” items in global media and one that

causes more debate – and sometimes angst – than just about any

other area of the media. Sports rights are constantly in the news

as the price of delivering key events to viewers increases year by

year. The AIB’s Simon Spanswick has been studying the form in

sports broadcasting

SPORTS, RIGHTS,

SPONSORS,FANS

40

|

ISSUE 2 2015

|

THE CHANNEL

port touches a

majority of people

on the planet,

whether they are

participants or

spectators. From

golf to Formula 1,

cricket to football, sport is an

immense global industry. According

to PwC, sport will be worth around

US$150billion this year, up from

US$120billion in 2010. While

merchandising, product

endorsement and hospitality are

big income generators, it is the sale

of broadcasting rights for major

events and sports leagues that

delivers the greatest revenues to

rights holders.

Dizzying sums of money are

now being spent by broadcasters –

in particular pay-TV operators – to

secure rights of key events. The

broadcasters’ aim is to maintain –

and increase – audience numbers.

It’s a model that’s worked highly

successfully in Europe, where Sky -

in the UK, Germany and Italy - has

gained exclusive rights to key

events, particularly football (soccer)

and as a result has secured new

subscribers keen to watch content

that’s no longer available on free-to-

air networks.

In Germany, public and free-to-

air commercial channels have been

left with what some might consider

the dregs in football TV rights -

highlight and round-up programmes

for the Bundesliga, rather than live

coverage of matches. In the UK, the

BBC shares F1 with Sky, showing

ten of the 19 races live with

highlights for the rest.

Meanwhile, sports leagues rub

their hands in glee as more money

than ever before is put on the table

by broadcasters. In theory, the extra

S

TV (and increasingly now digital)

rights revenues should help sport’s

development, making cash

available to refurbish existing, or

build new sports arenas and stadia,

alongside the funding of grassroots

initiatives to bring the youth into

sport and develop their skills.

NEWPLAYERS

New entrants in the European pay-

TV market, like BT Sport in the UK

and beIN SPORTS in France, have

shaken up the market. Over the

past three or four years, these

newcomers have taken the fight to

established pay-TV operators Sky

and Canal+ (owned by Vivendi),

out-bidding them for rights for key

football (soccer) competitions.

Since its launch in France in

2011, beIN SPORTS has moved

from football into other sports,

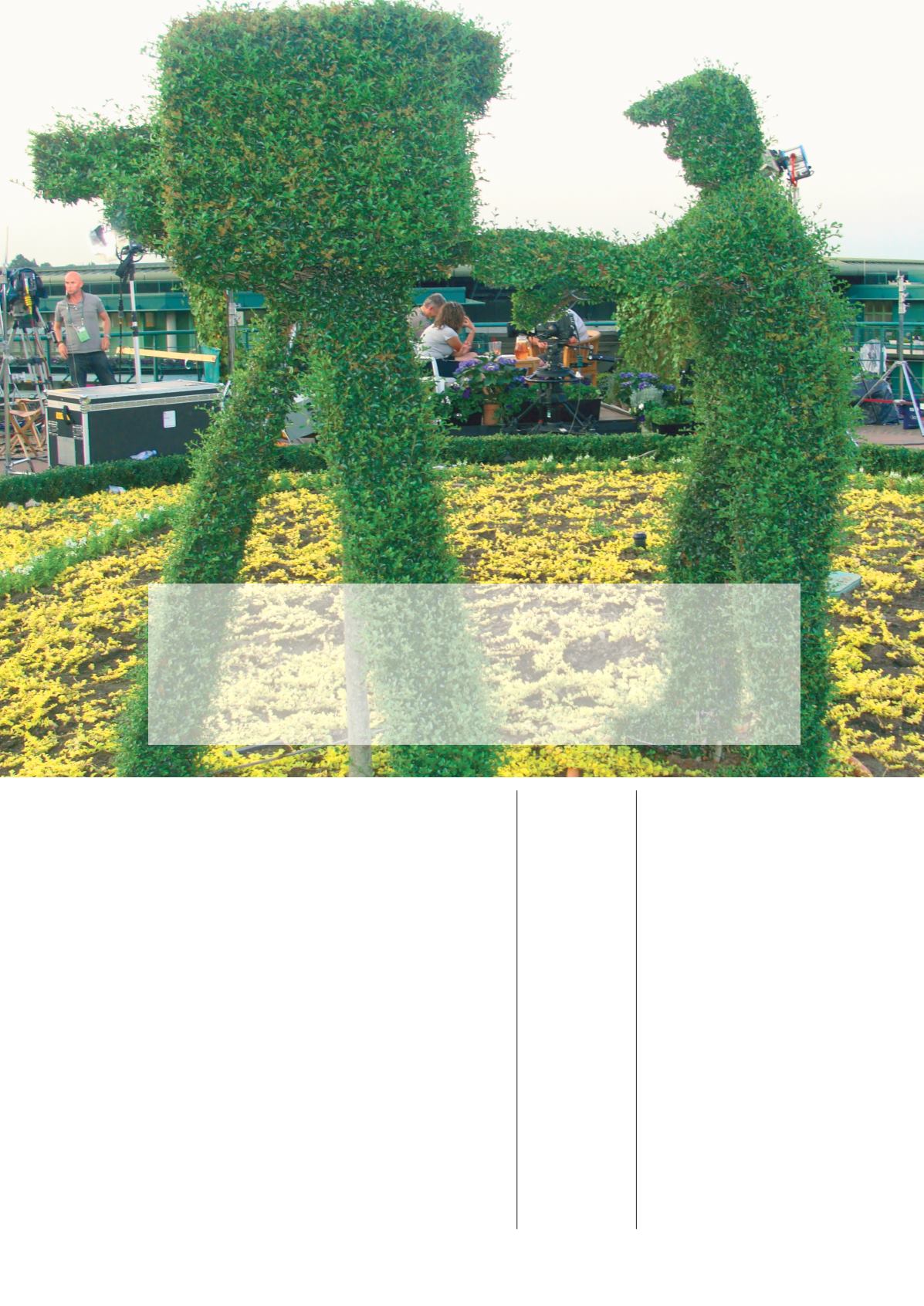

including Wimbledon (lawn

Pay-TV

platforms

are

spending

dizzying

sums on

rights

“

”